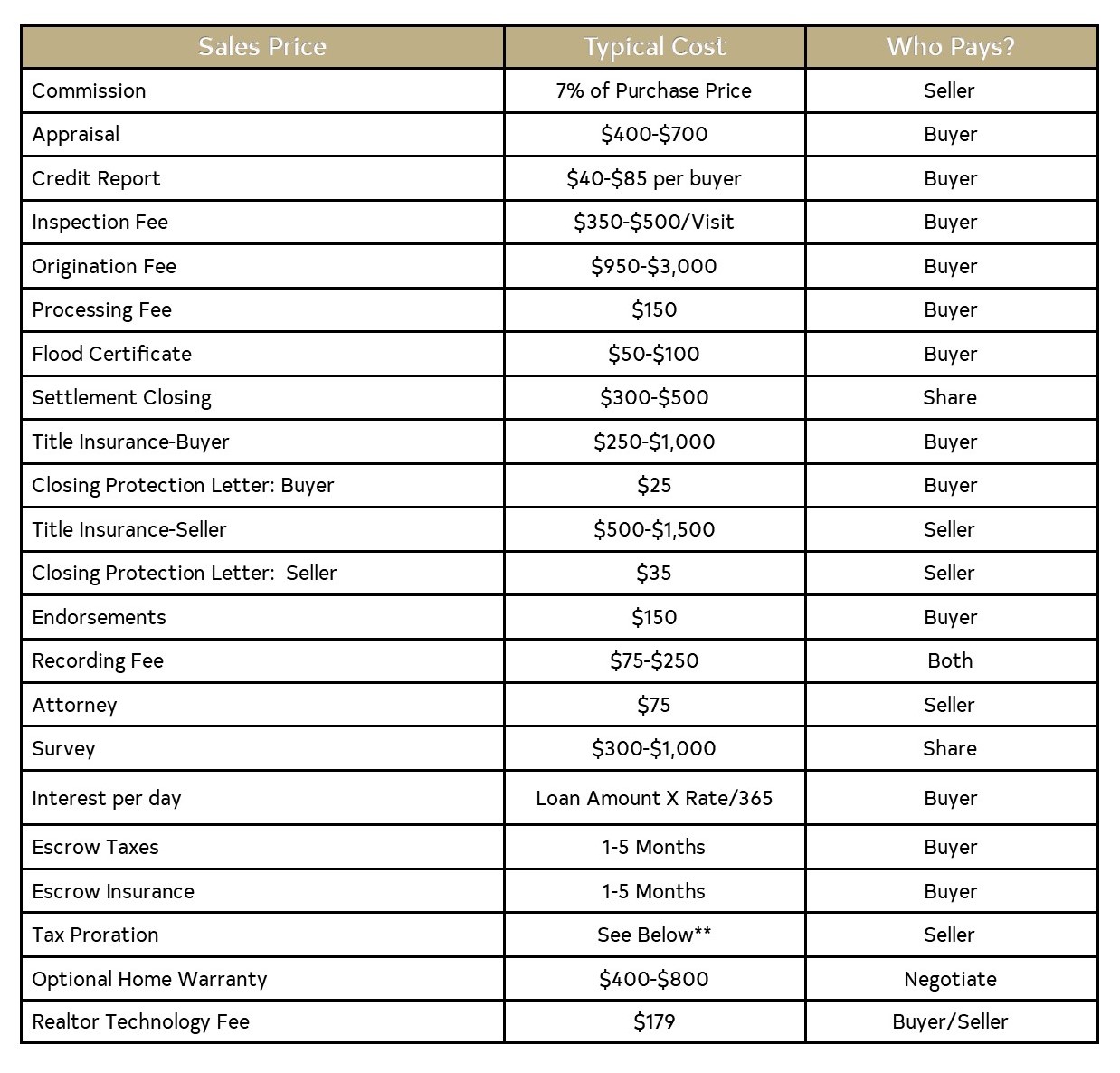

Closing Costs

**Indiana property taxes are paid in arrears. Property tax prorations include any unpaid taxes for the previous year plus the prorated amount for the current year. Taxes are typically paid to the County Treasure on May 10th and November 10th.

Taxes paid in May 2019 are for January 1, 2018 through June 30, 2018.

Taxes paid in November 2019 are for July 1, 2018 through December 31, 2018.

Here’s how to calculate your prorated taxes:

Take prior year taxes divide by 365 = daily tax rate Daily tax rate x days passed in current year = Current year taxes accrued Current taxes accrued + Prior Year unpaid Taxes = Total Tax Proration.

Have any questions?

Call or text: 317.413.1360

Email me: LeeAnnBalta@C21Scheetz.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link