Step 24: Attend Closing

It’s closing time!

An email confirming the date, time, and location will be sent out before closing.

Once the closing is confirmed, we recommend calling to confirm your movers one last time. Make sure they have the proper size crew and truck to complete the move efficiently. If you are moving out of a condo and are not on the first floor, let them know, especially if your building doesn’t have an elevator. Most closings take approximately an hour but can take longer. If you are moving on the day of closing, please be sure to give yourself enough time to complete it before you need to meet your movers.

A few important reminders for closing:

-

Bring your photo ID with you (ideally a driver’s license or passport).

-

Bring your checkbook (just in case).

-

Closing takes approximately an hour but could be longer.

People present at the closing:

-

The title officer, who runs the show. He/she reviews all the documents and makes sure everything is appropriately signed, sends all of the signed documents to the underwriter for one last review, and issues any refund checks at the end of closing.

-

I will be available should any problems arise. If I’ve done my job, the closing is anti-climactic.

-

You, the buyer. Be prepared to sign all the required documents.

-

The seller’s agent. The seller’s Realtor will be available should any problems arise.

-

The sellers, who will also be signing all the required documents, and answering any last-minute questions you may have.

At some point, the title officer will provide you with details on how to file exemptions. Make sure you understand how and when the taxes get paid and how to get the exemptions (homeowner, mortgage, and senior citizen) you are entitled to as these usually save you several hundred dollars per year.

At the very end of the closing, the title officer may give you an overage check, which is a refund of any money you transferred when you sent your down payment and closing cost fees. You’ll also receive a copy of the Closing Disclosure. Hold on to this! You’ll need it next year when you prepare your taxes.

Last, but not least, you’ll get your keys and can now officially move in!

Congratulations new homeowner!

Step 25: Wrapping Things Up

We made it!

You’re a new homeowner and, hopefully, you’re getting settled into your new place. Now that we’re past closing, we want to wrap up the last few items:

-

Going forward we will send you reports on what is happening with property values in your area, so you know how quickly your home is gaining value.

-

You’ll also receive our periodic newsletter and invitations to our seasonal client appreciation events. It is my sincerest hope that we remain connected.

-

We recommend setting up a Google alert on your new property. Please see Setting Up a Google Alert to Protect Your Property

-

Lastly, we were hoping you’d be willing to write a review for us – you’ll be receiving an email via RealSatisfied or Zillow. Any kind words you could share with others would be much appreciated as we don’t advertise. Instead, most of my business comes from word of mouth. Please keep me in mind should any of your family or friends need real estate assistance.

Thank you again for trusting us with your home purchase and please don’t hesitate to reach out to us if we can provide you with referrals for painters, contractors, handymen, etc.

The Mortgage Underwriting Approval Process

What to Expect and How Long It Take

Updated October 30, 2018

On the fun scale, the mortgage underwriting approval process often feels like an exceptionally long dental appointment. You’ve dutifully gathered the mountain of documentation required to obtain a mortgage… or so you thought.

You’ll either hand them over to your loan officer or you’ll give them to an assistant or a processor. Either way, your documents will be reviewed for thoroughness, completeness, and accuracy, and almost everyone messes something up. They forget something or miss a signature. Your missing documents or signatures will be requested along with clarification on anything that’s not crystal clear about your docs.

And so it begins.

Getting Started

You’ll probably be quizzed right off the bat about any large deposits in your checking or saving accounts or how your 401k is vested, at least if you’re planning on making a down payment of less than 20 percent. This is standard so roll with it, but hustle with your answers and any additional documentation. It’s absolutely needed for the next step: underwriting.

Your Choice of a Lender

The next step in the much-ballyhooed “underwriting process” can vary a great deal depending on your loan officer and your choice of a lender. The mortgage lender and loan officer you choose, the type of loan you need, and the general level of detail you’ve put into gathering your documents will play a large part in determining your personal level of “underwriting discomfort”.

Your file will be passed on to a corporate mortgage processor in a centralized location that is typically nowhere near you, at least if you went with a big bank. These processors are typically overworked and underpaid so you can expect a more lengthy approval process. They try to maximize a number of loan files that everyone has to process/underwrite—it’s a quantity-over-quality approach.

Smaller lenders and independent mortgage brokers usually staff cohesive in-house teams. This results in more efficient operations and everyone is under one roof.

There are many good reasons to use a big bank and some of them are valid. They can generally afford to take more chances than the little guy, and that’s great if you find yourself in a gray zone for approval. They also typically offer a wider variety of niche mortgage products for things like renovation and construction financing. But you’ll have to give up a little something in the way of efficiency in exchange for these advantages.

The Effect of “Turn Time”

All mortgage lenders have a “turn time”, the time from submission to underwriter review and the lender’s decision. The turn time can be affected by a number of factors big and small. Internal policy on how many loans operations the staff carries at one time is often the biggest factor, but things as simple as weather conditions—think Rochester, NY in the winter—can throw lender turn times off quickly.

Ask your loan officer what she expects your turn time will be and consider that factor in your ultimate choice of a lender. Keep in mind that purchase turn times should always be less than refinance turn times. Home-buyers have hard deadlines they must meet so they get underwriting dibs.

Your purchase application should be underwritten within 72 hours of underwriting submission under normal circumstances and within one week after you provide your fully completed documentation to your loan officer.

Approved, Denied, or Suspended

The underwriter will typically issue one of three dispositions to your application: approved, denied, or suspended.

If it’s approved, underwriting will typically assign conditions you’ll have to meet for full approval. This might be clarification regarding a late payment, a large deposit, or a past life transgression. It could simply be a missed signature here or there.

If it’s suspended—which is not completely unusual—the issue of underwriting becomes more confused and needs clarification. These delays are typically employment- or income-related, but occasionally an asset verification question can also lead to a suspension. In this case, you’ll get two conditions: one to clear the suspense and the standard conditions needed for full approval.

Finally, you’ll want to find out exactly why if you’re denied. Not all loans that start as denials end up that way. Many times a denial just requires you to rethink your loan product or your down payment. You might have to clear up a mistake in your application or on your credit report.

Approved With Conditions

The status of the vast majority of loan applications is “approved with conditions”. This is referred to as “conditional approval”. The underwriter simply wants clarification and additional docs, mostly to protect himself and his employer. He wants the closed loan to be as sound and risk-free as possible.

Quite frequently, the additional items aren’t requested to convince the underwriter but rather to make sure the mortgage meets all the standards required by potential secondary investors who might end up buying the closed loan when everything is said and done.

Your Role in All This

Your primary job during the time your loan is in underwriting is to move quickly on document requests, questions, and anything else that’s asked of you. No matter how ridiculous you think the doc request might be, set that hoop aflame and jump through it as quickly as possible.

Do not take the inquisition personally. This is just underwriting does. Just handle the last few items and submit them so that you can hear the three best words in real estate—”clear to close”!

That’s it. You’re done. There will be only a few more routine hoops to jump through. Cut your down payment check, sign on the dotted line, and get ready to move.

Working With Real State Agents

Playing by the rules keeps the peace between buyers and real estate agents

Playing by the rules keeps the peace between buyers and real estate agents

BY ELIZABETH WEINTRAUB, Updated August 03, 2018

One of my buyers is a brilliant neurosurgeon, top of her class in medical school, but she doesn’t have a clue about etiquette rules with real estate agents. Nor does she understand why some listing agents have yelled at her when she calls them at random with questions. In her mind, she hasn’t done anything wrong. She is only trying to find out information about a house for sale.

Real estate agents love working with people, but there are always clients who may unintentionally cross the line. Here are a few simple protocols you can use while shopping for a home that will keep you out of hot water and on good terms with real estate agents. Especially your own agent.

Understand Agents Work on Commission

- Very few real estate agents work on salary and if they do, you probably don’t want them.

- Most real estate agents are paid a commission. If an agent does not close a transaction, she does not get paid. Agents are highly motivated to do a good job for you.

- Agents are not public servants and do not work for free. Do not ask an agent to work for you if you intend to cut the agent out of your deal.

Keep Appointments and Be on Time

- Be respectful, use common courtesy and don’t expect an agent to drop what she is doing to run out and show you a home. You are probably not that agent’s only prospect or client. And if you are, lord help you.

- Do not make an appointment with an agent and then forget to show up.

- If you are running late, call and let your agent know when you expect to arrive. Just show respect.

Choose a Real Estate Agent

- Decide whether you want to work without representation, dealing directly with listing agents, or if you want to hire your own agent.

- If you decide to hire your own agent, interview agents to find an agent with whom you are comfortable.

- If you are interviewing agents, let each agent know you are in the interview stage.

- Never, never, never interview two different agents from the same company. Trust me: Don’t do it.

Do Not Call the Listing Agent If You Are Working With a Buying Agent

- Listing agents work for the seller, not the buyer. If you hire the listing agent to represent you, that agent will now be working under dual agency. Conflicts of interest may occur.

- If a listing agent shows you the property, the listing agent will expect to represent you. Ethics prevent a listing agent from showing preferential treatment. If you ask a listing agent to do you a favor and try to discount the price, it’s comprising integrity and most won’t do it.

- Listing agents do not want to do the buying agent’s job. Let your buyer’s agent do her job.

Practice Open House Protocol

- Ask your agent if it’s considered proper for you to attend open houses In some areas, it’s frowned upon to go to open houses unescorted.

- Hand your agent’s business card to the agent hosting the open house. Sometimes this agent will be the listing agent, but often it is a buyer’s agent also looking for unrepresented buyers. Announcing you are represented protects you.

- Do not ask the open house host questions about the seller or the seller’s motivation. Let your agent ask those questions for you. Your agent will probably use a different approach that works.

Sign a Buyer’s Broker Agreement With a Buying Agent

- Expect to sign a buyer’s broker agreement. It creates a relationship between you and the agent and explains the agent’s duties to you, and vice versa.

- Ask about the difference between an Exclusive and Non-Exclusive Buyer’s Broker Agreement.

- If you’re not ready to sign with a buyer’s broker, do not ask that agent to show you homes. Otherwise, a procuring clause may pop up.

- Ask your agent if she will release you from the contract if you become dissatisfied. If she refuses, hire somebody else. Your agent should also be respectful of your goals.

Always Ask for and Sign an Agency Agreement

- By law, agents are required to give buyers an agency disclosure. This document varies across state lines.

- Signing an agency disclosure is your proof of receipt. It is solely a disclosure. It is not an agreement to agency. Read it.

- The best and most practiced type of agency is the single agency. This means you are represented by your own agent, who owes you a fiduciary.

Make Your Expectations Known

- If you expect your agent to pick you up at your front door and drive you home after showing homes, tell her. Many will provide that service. If not, they will ask you to meet at the office.

- Let your agent know how you want her to communicate with you and how often. Do you want phone calls, emails, text messages, IMs or all of the above?

- Set realistic goals and a time frame to find your home. Ask your agent how you can help by supplying feedback.

- If you are displeased, say so. Please. Agents want to make you happy. Don’t be afraid to speak up.

Do Not Sign Forms You Do Not Understand

- Do not feel silly for asking your agent to explain a form to you. It’s her job. Many forms are second nature to agents but not to you, so ask for explanations until you are satisfied you understand.

- Try not to sign forms titled “Consent to Represent More Than One Buyer.” This is never in your best interest. But sometimes you can’t help it because your agent could work for a large brokerage. That brokerage could represent more than one buyer, not your agent.

- Realize agents are not lawyers and cannot interpret law. Don’t ask agents to give a legal opinion, prefaced by the statement you are not asking for a legal opinion.

Be Ready to Buy

- If you aren’t ready to buy, you don’t need a real estate agent. You can go to open houses by yourself and call listing agents for showings—but be honest. Say you are “only shopping.” Look at homes online, but don’t waste an agent’s time if you aren’t ready to act.

- If possible, hire a babysitter to care for children who are too young to stay out all morning or afternoon touring homes.

- Bring your checkbook. You’ll need it to write an offer because an earnest money deposit may be required to accompany your purchase offer. And please, be pre-approved.

Buying a Home Step by Step

When I represent you as a buyer, I am your advocate, guiding you through the home buying process.

My ultimate mission in life is to serve others, and I love families. I am truly blessed to have found an avenue for both passions, by helping families find their next backyards! Understanding that no two families are the same, I know that their solutions can’t be the same. I connect with my clients by listening to their hopes, dreams, and expectations.

Only after understanding their perspectives am I able to I share what I’ve come to learn about the real estate process and how that fits into their desires, to prepare them for what they should expect, navigate them through the home buying process, and empower them to make decisions that work best for their family.

As an entrepreneur and business owner, I come equipped with the knowledge, network, and experience to get us to the closing table. I go above and beyond the average agent by doing my best at making the process as pleasant as possible, and even support the family by ordering pizza for moving day!

I am here to help you identify the best home for the best value and to educate you throughout the entire process, so you know you’re making the best short- and long-term financial decision. To read my reviews from past clients visit Real Satisfied, Zillow and Trulia.

For most people, buying a home is the most expensive purchase they will ever make. That requires a clear understanding of the transaction.

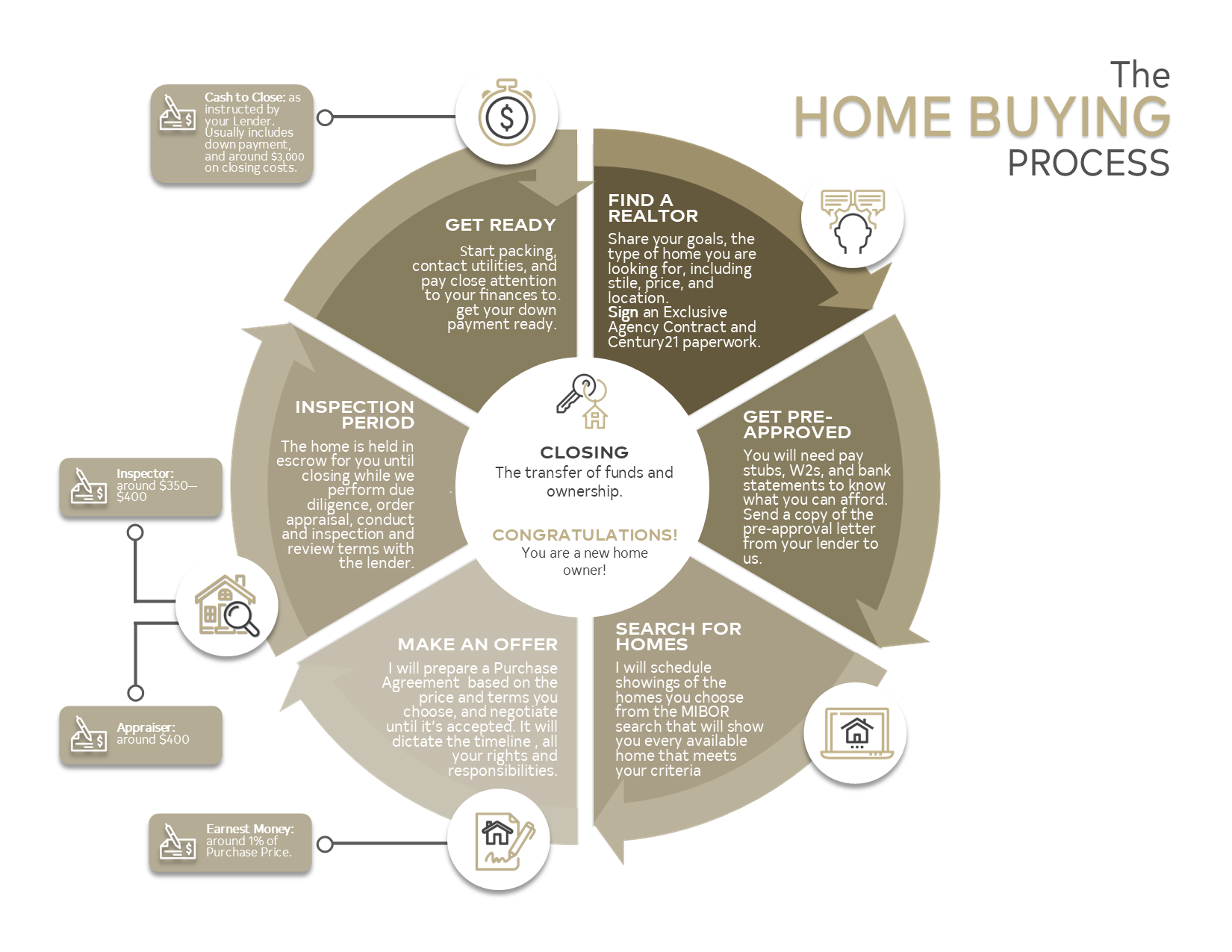

The Stages of Buying a Home

(Click on the Icons for more information)

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link