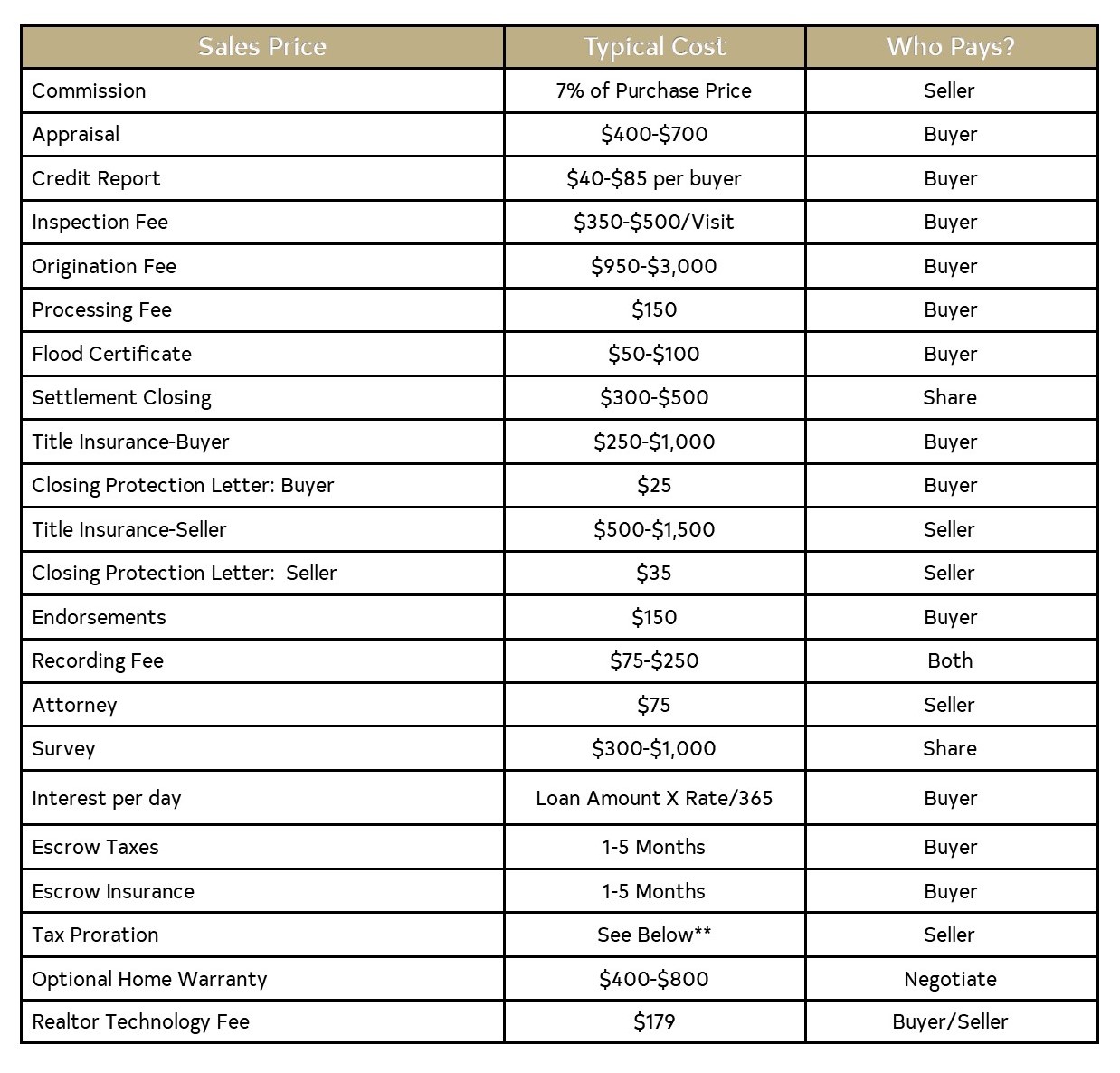

Who Pays for What

Closing Costs

**Indiana property taxes are paid in arrears. Property tax prorations include any unpaid taxes for the previous year plus the prorated amount for the current year. Taxes are typically paid to the County Treasure on May 10th and November 10th.

Taxes paid in May 2019 are for January 1, 2018 through June 30, 2018.

Taxes paid in November 2019 are for July 1, 2018 through December 31, 2018.

Here’s how to calculate your prorated taxes:

Take prior year taxes divide by 365 = daily tax rate Daily tax rate x days passed in current year = Current year taxes accrued Current taxes accrued + Prior Year unpaid Taxes = Total Tax Proration.

Have any questions?

Call or text: 317.413.1360

Email me: LeeAnnBalta@C21Scheetz.com

Step 5: Time for Showings!

You’ve found properties you want to see, and we’ve set up your showing times. Generally, the day before we are scheduled to look at homes, I will email you the route so you will know where we are meeting. Leave yourself plenty of time to get there.

Before we head out here are a few important things to know:

-

Most sellers require you are pre-approved before being able to see their homes.

-

Sellers put limitations on showings such as no showings after 6 pm or on Sundays, etc. Ideally, we will schedule showings a day in advance to give sellers ample time to prepare.

-

Wear comfortable slip-on shoes as we may be asked to remove our shoes in some homes.

-

If a lot of sunlight is important to you in a home, have me schedule showings during daylight hours.

-

Dress for the weather. The walkway or driveway may be snowy, icy, muddy, etc. The house may or may not have AC or heat.

-

Vacant houses may not have any utilities turned on.

-

Don’t assume we’ll be able to use the restroom so plan accordingly.

-

Focus on the property, not the furnishings, artwork, etc., as you’re buying the property, not the contents.

-

Avoid touching furniture or personal items as we don’t want to be responsible should something break.

-

Remind children not to play with the toys or objects they see in the house.

-

The home inspection comes AFTER a contract is agreed upon and signed by both the buyer and seller. During a typical showing, we should not be in the crawl spaces, attic, etc.

-

Some sellers will have Nanny Cams in their homes so be aware of what you say and do. Don’t talk about how much you can afford, or what kind of offer you want to make while in the house, in case someone is listening.

-

If sellers are home, be careful not to give too much away about yourself or why you’re buying, as that could hurt us later during the negotiation process.

Bring drinks and snacks as looking at lots of homes can be draining!

Step 6: Do You Want a Home Warranty?

A Home Warranty is not the same thing as homeowner’s insurance, nor is it a replacement for homeowners’ insurance. Homeowners insurance covers major perils such as fires, hail, property crimes, and certain types of water damage that could affect the entire structure and/or the homeowner’s personal possessions. A home warranty is a separate contract covering repairs and replacements on systems in your home. Usually, coverage is for one year. For new construction that has never been lived in, the builder should give you a one-year warranty and after that, the home warranty kicks in for a certain amount of time.

What does a home warranty usually cover?

Policies differ depending on which company your warranty comes from. In general, a home warranty will cover your home’s appliances and systems, such as electrical and plumbing. The home warranty usually does NOT cover exterior features such as the roof, fencing, decking, landscaping, or water intrusion due to a structural issue, etc.

The cost depends on several factors, such as how old your home is, how big it is, and what you want to have covered. Usually, the cost is between $500 and $1,000. Always compare policies before purchasing.

When something breaks, there is usually a service call fee of approximately $75 per trip. With most warranty programs, there are no additional fees to repair an item beyond the service call. Also, while home warranties cover many of your new home’s crucial systems and appliances, those items must be in working order before the contract. When you buy a home warranty, consider premium and optional coverage to customize the plan to fit your needs, especially if your home has more than one oven, dishwasher, a wine fridge, etc. These extra appliances may not be covered under the standard warranty.

Who pays for the home warranty?

That depends. Sometimes we negotiate for the seller to provide a home warranty as part of the contract negotiations. In that case, the home warranty would be provided and paid for by the seller. You’ll then receive the details of the home warranty at the closing. If we did not ask for a home warranty as part of the contract, then you need to decide if you want to purchase one.

What if an appliance can’t be repaired and needs to be replaced?

The home warranty company will try repairing the item first. If that doesn’t work, they will usually replace it with a model that has similar features. For instance, if you have a fridge that has an ice machine and a water dispenser, you’ll get one with the same features. However, it most likely won’t be the same brand. For instance, American Home Shield normally replaces all appliances with a GE brand. Therefore, if you have a Sub-Zero fridge, you’re most likely not getting another Sub-Zero. Instead, you’ll get a GE fridge with similar features. If you really want a Sub-Zero, most warranty companies will give you the cost of the GE fridge in cash and you can put it toward purchasing the Sub-Zero on your own.

Where can I buy a home warranty?

You can find the best home warranty for your needs by searching for websites that compare and rate home warranty companies. A trusted site like Consumer Reports www.consumerreports.org is a good place to start. Or I can order one for you through HSA Home Warranty to begin on the day of closing.

When a home warranty is understood and utilized for its intended purposes, it saves on home repairs and reduces the extra stress that comes with buying or selling a home.

Step 7: Make an Offer on a Home You Love

You’ve found the perfect backyard and want to put in an offer.

Fabulous!

In today’s market, we need to put your offer in asap, ideally within a few hours. Before we can put an offer on a home, there are a few things we need to get from you:

Full legal name: If you haven’t already done so, please provide us the full legal name of anyone who will be on the contract as well as their phone number and email address.

Offer price: What price do you want to offer for the home? Let’s have a discussion about the sale-to-list price ratio in the neighborhood. It will tell you a lot about whether you should expect to pay below the asking price, asking price, or above the asking price based on today’s market.

Your walk-away price: Don’t expect to pay your initial offer price as it’s rare for a seller to accept your initial offer without some negotiating back and forth. That’s why it’s called an initial offer. In addition to deciding what offer you want to put in to start, we need you to decide now how much you’re willing to pay for this property and what your walk-away price is before things get heated and emotional.

Closing date: Typically, in Indiana, closing takes place 30 days from contract acceptance. Sometimes you can ask for a later closing date depending on the seller’s needs, but we wouldn’t expect it. Therefore, if you want to move around July 1, plan on putting in offers at the beginning of June. If you’re paying 100% cash you can often close faster than 30 days (around 21 days), but 30 days is usually the required minimum if you’re using a mortgage to buy the property. If you are getting down payment assistance, we’ll likely need 45 days as there are typically more details to address.

Earnest money: Earnest money is essentially a good faith payment showing you are serious about moving forward with the purchase. How much earnest money are you comfortable putting down on this property? Typically, contracts in Indiana ask for 1% of the purchase price as earnest money. Earnest money is due within two days of contract acceptance. The earnest money is part of your down payment. For example, if you’re planning on $40,000 for a down payment and you’re paying $15,000 in earnest money, at closing you would owe an additional $25,000 for the remainder of the down payment.

Down payment: Depending on your particular loan program the down payment could be anywhere from 0% up. Personally, I like to see the buyer put down at least 5% (20% is ideal) unless you are doing a special loan program like a VA or FHA loan. The more you are putting down, the higher the chance that your loan receives approval.

Closing cost credits: Do you want to ask the seller to pay for part of the closing costs? If so, how much?

Home warranty: If you haven’t purchased a home warranty, do you want to ask the seller to provide a home warranty?

Contingencies: Any other contingencies we need to be aware of? Do you need to sell your current home before you can buy this home, for example?

Lastly, buyers sometimes want to know what happens if the contract is accepted and they have a change of heart or the inspection reveals a huge problem. If the inspection reveals a huge problem (aka defect) I can help you navigate through that for a reasonable outcome (see lines 214 through 223 of the Purchase Agreement for an explanation of defects and how to handle them). If you have a change of heart and decide not to go through with the purchase, you must consult a real estate attorney for advice.

Want to review the contract in advance? Click to see a blank Purchase Agreement.

Step 8: You Have an Accepted Offer!

Now What?

Congratulations on having an accepted contract on a house. Until we have an executed contract (which means everything has been signed by both the sellers and the buyers) we do not have an enforceable contract. That is why it’s urgent that a signed contract be received by all parties asap and within designated timelines. Once a signed contract is received, several things need to happen:

-

I will send the contract to your mortgage lender. This lets your mortgage lender know that you’re under contract and it starts the process for getting you approved for the mortgage (remember, right now you’re only pre-approved). Be sure to respond promptly to your mortgage lender. They will ask you to fill out a lot of paperwork. Some mortgage lenders joke it’s like getting a financial colonoscopy. Unfortunately, it’s not optional; it’s required and the quicker you can fill it out and get it back to them, the better. Read Things Not to Do.

-

Write and drop off the earnest money check. The earnest money check is made out to the seller’s agent’s brokerage and is in the form of a personal check. It should be dropped off at the seller’s agent’s office within 2 business days of contract acceptance. I will provide you with this information. Send me a picture of your check so that I may track it internally.

After the above steps are complete, I’ll email you every few days with an additional next step. Think of it as our friendly way of giving you homework to ensure a smooth transaction and help you make sure everything gets done on time.

Step 9: Schedule a Home Inspection

Once we’ve negotiated the Purchase Agreement, you will need to schedule your home inspection as soon as possible. Ideally, the inspection should occur within the next 2-3 days; however, during the busy summer months, inspectors may be booked out up to a week or more in advance.

Plan to attend the inspection (see details below) which takes approximately 2 hours for a condo and 3 hours for a single-family home. Inspectors usually only work Mon – Fri and do not work evenings or weekends so you will probably need to arrange to be off work for the inspection.

Your inspector will schedule access to the home through Centralized Showing Services which obtains approval from the sellers.

It often takes the inspector an additional 1-2 days to write the report after the inspection. Once the report is written we still need some time to review it and ask the seller for any credits or repairs before the inspection period ends, which is expressly spelled out in our purchase agreement, but usually within 10 days.

You may choose any inspector, but here are a few companies we trust.

· Heartland Housemaster

trent.paino@housmaster.com

Phone (317) 209-9100

· Pillar to Post Home Inspectors

joncarrothers.pillartopost.com

Phone (317) 550-4044

· Cornerstone Home Inspections

tjohnson@cinspction.com

Phone (317) 815-9497

Step 10: Don’t Spend Extra Money

THIS IS VERY IMPORTANT SO PLEASE READ AND TAKE HEED!

Your mortgage pre-approval was granted to you based on the amount of money you had at the time of the pre-approval in your savings accounts, checking accounts, retirement accounts, etc., and the amount of debt you had at the time (car payments, student loans, your current mortgage if you already own a home, etc.).

If you go out and buy a TV, a new car, new furniture, etc., between now and closing, it could put your chances of being approved for your mortgage in jeopardy as THE LENDER PULLS YOUR CREDIT ONE MORE TIME THE DAY BEFORE CLOSING. Therefore, it is imperative that you spend as little money between now and your closing date as possible.

In addition, be sure to pay all of your monthly bills on time. Don’t open or close any credit cards or lines of credit, don’t take out new loans, don’t take extravagant vacations, and don’t pay off any debts. Often buyers think it won’t make a difference if they buy a couch, new TV, etc., and charge it to their credit card, but it very well could put your loan in jeopardy.

See Things Not to Do. Again, please do not buy ANYTHING big until after closing. Then go wild!

If in doubt as to whether a potential purchase will affect your ability to obtain a mortgage, please speak with your mortgage lender.

Step 11: Schedule the Closing on Your Calendar

Now that you have an executed contract, it’s important to put the closing date on your calendar and arrange to take the day off from work.

Here are a few things to know about your closing date as specified on your executed contract:

-

It could change. So many factors can cause a closing date to be pushed out—a family emergency, a request for additional documentation, a last-minute discovery of a defect in the home, etc.

-

Generally, the parties make every effort to close at a location close to the property being purchased.

It’s best to attend the closing in person. However, if you absolutely can’t be there, notify me, your mortgage lender, and the title company. The title company will create a Power of Attorney (POA) so that I or someone else can represent you. This needs to be done at least two weeks in advance of closing, as your mortgage officer needs to review and approve the POA, it needs to be signed and notarized, and the original signed paper copy must be returned to the title company at least one day before closing. In addition, enclose a letter explaining why you can’t attend the closing.

Step 12: Set Up Homeowner’s Insurance

One of the things the mortgage underwriter will require you to do is to set up homeowner’s insurance. It’s best to get a start on this task now. Like most people, your home is the biggest purchase you will ever make, and you want to make sure it’s properly insured.

Our biggest piece of advice is to shop around because rates can vary dramatically. We recommend starting with the company that insures your car or your current home and getting a quote from them first. You’ll likely get a discount for already having insurance through them. After that, reach out to our two recommended providers for quotes:

-

Pemberton Insurance Group, Keith Pemberton: 317-656-7793

-

Ward Insurance Company, Andy Ward: 317-344-6694

Insurance Research

The research to obtain the quote will bring attention to any past property claims or flood zones that may affect your quote. You should not expect to see anything that was not already disclosed. If something new does pop up, it’s best to address it now, before closing. When you choose your insurer, send a copy of your policy to me and your lender.

Have your homeowner’s insurance policy go into effect the day BEFORE you close on your new home. That way if (heavens forbid) your new place burns down while you’re at closing, you’ll be covered. Again, get proper documentation from your insurance company to provide to your lender; they will require proof of insurance before they’ll approve you for your loan.

Step 13: What is the Inspection Period?

Now that a contract has been executed and earnest money dropped off, we are officially in the Inspection Period.

During this period, we conduct the inspection and negotiate the resolution of any findings made by the inspector. Sellers need adequate time after we submit our response to call the necessary service providers and get estimates for any repairs. Defects that were previously disclosed are not grounds for terminating the contract and should be addressed in the Purchase Agreement.

What is a Defect?

Under Indiana law, “Defect” means:

-

a condition that would have a significant adverse effect on the value of the house,

-

that would significantly impair the health or safety of you and your family,

-

or if not repaired, removed, or replaced would substantially shorten or adversely affect the expected average life of the premises.

In not so many words, we will address everything expensive, dangerous, or structural.

We will get an Inspection Response from the sellers after they gather their quotes and professional advice, and the game of negotiations will start! Don’t worry. Remember that I am your relentless advocate.

Your part in the game is to hang tight and be patient at this time. If we cannot get all of the above completed during the time frame agreed upon in the contract, we can ask for an extension of the inspection period.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link