Step 25: Closing Day!

The closing day is here!

Whoo-hoo!

Our title company will make sure everything goes smoothly and review the Closing Statement in more detail showing the exact breakdown of the closing cost charges. The title agent will arrange for the balance of your loan to be paid off with the proceeds from closing. If you are receiving additional money back from closing once your loan has been paid off in full, the title company will either transfer it electronically to your account of choice or provide a check at closing.

There will be a lull in the closing process when the title agent sends signed documents to the buyer’s lender. This is a great time to exchange keys and answer buyer questions.

And that’s it! Congratulations on a successful sale.

Thank you for trusting us to sell your home.

A few important reminders for closing:

-

Bring your photo ID with you (ideally a driver’s license or passport). Closing takes approximately an hour but can be longer.

The following people are usually present:

-

The title officer, who runs the show. He/she reviews all the documents and makes sure everything is appropriately signed, sends all of the signed documents to the underwriter for one last review, and issues any refund checks at the end of closing.

-

I will be available should any problems arise. If I’ve done my job, the closing is anti-climactic.

-

You, the seller. Be prepared to sign all the required documents.

-

The buyer’s agent. The buyer’s Realtor will be available should any problems arise.

-

The buyers, who will also be signing all the required documents, and asking us any last-minute questions they may have.

Step 26: Review Me!

Last step!

Please consider taking a short survey and reviewing us. The survey will come from ‘RealSatisifed Survey’ and Zillow.

We don’t advertise much our services and rely largely on referrals, so let us know how we did and consider recommending me to your family and friends. We would really appreciate it!

Thank you again from the bottom of our hearts for reviewing us and we hope you’re enjoying your new home.

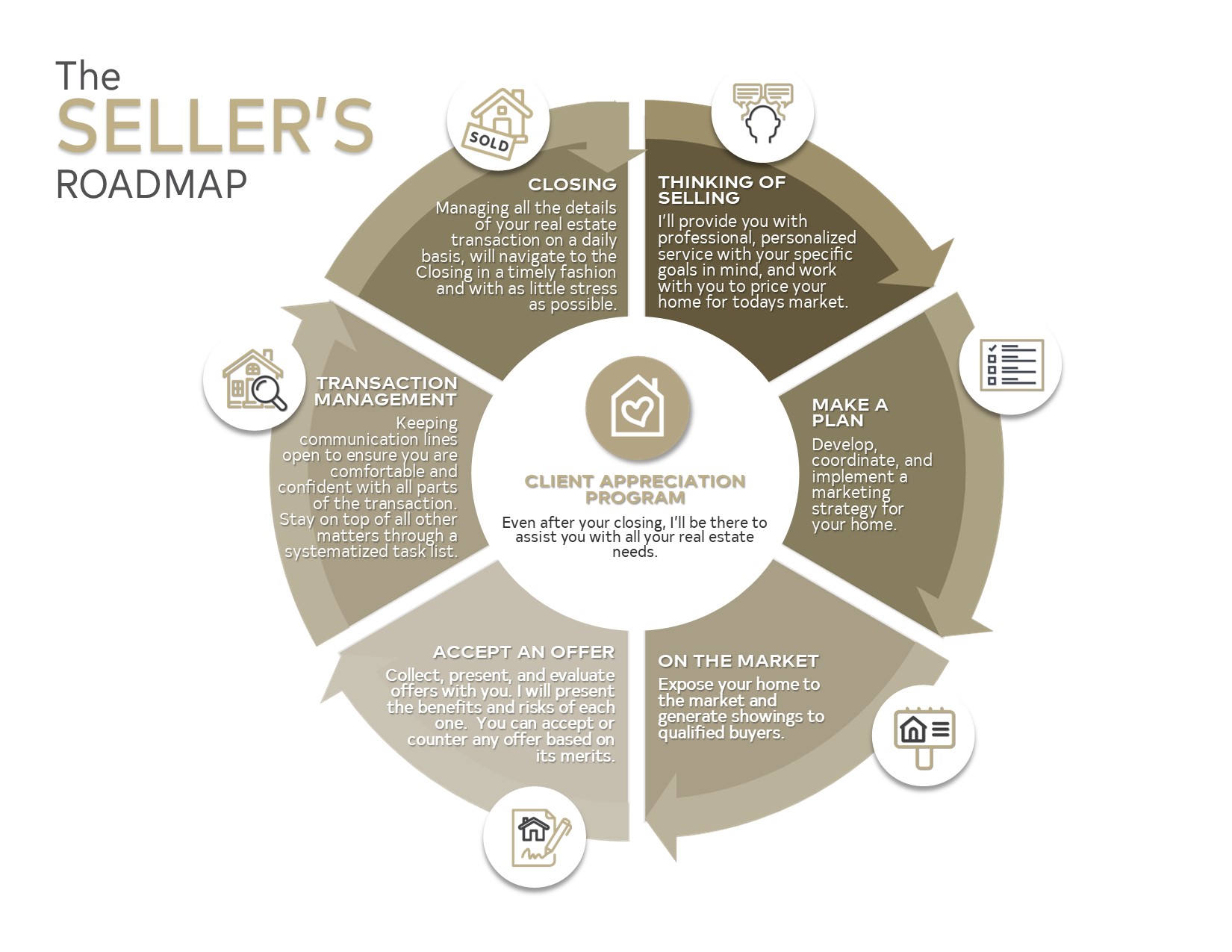

Selling Your House Step by Step

For most people, selling a home means leveraging one of their greatest assets for the next juncture in their life. That requires a clear understanding of the transaction.

Check out the estimate of closing costs, Who Pays for What? which is the approximate amount of fees you will need to pay out of the proceeds from the sale of your home.

When you work with me, I will lead you through the process using my expert knowledge to explain

The Stages of Selling Your House

(Click the icons for more information)

Service Providers We Trust

MOVING & STORAGE

ALLIED Morse Moving & Storage

Michael Knowles

Mobile (317) 200-6308

Fire Dawgs Junk Removal

Matthew Olson

Mobile (317)-291-3294

PAINTING & WALL REPAIR

1st Class Painting

Santos García

Mobile (317) 418-0559

Rodolfo Carmona

Exact Painters

Mobile (317) 981-9649

Jose Lupe Diaz

Lupe’s Painting

Mobile (317) 200-8506

HOME REPAIRS & HANDYMEN

Dan Princell

Unique Home Solutions

Mobile (317) 337-9345

Wayne Pickens

Mobile (765) 481-0858

PunchPro

Larry Carl

Mobile (317) 647-6320

mypunchpro.com

Hoosier Handyman

Phone (317) 418-8309

Seriously 24-7 LLC

Jason Lee

Mobile (317) 501-4964

Sub pump repair and Plumbing

Indiana Foundation Services

Phone (317) 397-0387

Sub pump repair, water in basement remediation.

Indiana Residential

Phone (800) 601-4050

Inspection Repair, roofing

Justin Hilgemeier

No Job Too Small, Just Handy

Mobile (317) 441-0698

Chimney Solutions

Mobile (317) 757-6979

Afordable Fence Builders

Mobile (317) 504-9775

6023 E 26th St

Indianapolis, In 46219

ROOFING

Jon Sobral

Mobile (317) 755-9461

Amos Exteriors

Phone (317) 359-3414

RENOVATION & CONSTRUCTION

A&S Remodeling

Mobile (317) 769-4734

P.o. Box 5101, Zionsville, IN 46077

Todd Wolford

Home Changers

Mobile (317) 852-2772

AG Constuction

Alex Gringauz

Mobile (317) 440-1225

FLOORING

Carlos Ocampo

Carpet Guy

Mobile (798) 699-1329

Jane Jasse

ProSand Flooring

Mobile (317) 508-5592

Enrique Velázquez

Carpets by Velazquez

Mobile (317) 833 4700

carpetsbyvelazquez@sbcglobal.net

CONCRETE

A 1 Concrete Levelers

Mobile (317) 733-6339

ACI Asphalt & Concrete Inc.

Notes: ask for Chris

Work (317) 549-1833

Mobile (317) 937-9075

CLEANING

ProSprayWash

Mobile (844) 337-7729

Roof, siding, concrete, and stone cleaner.

Phil Nicely

Heirloom Oriental Rug Cleaning

Mobile (317) 294-5812

Synthetic, natural and silk rugs

Sana-Bright Carpet Cleaners

Mobile (317) 334-1900

Indy Carpet Cleaners

Benjamin Moshe

Mobile (317) 217-0737

Lynn Bueke

Domestic Diva

Mobile (317) 345-6252

REMEDIATION

Phil Nicely

Midwest Remediation

Mobile (317) 294-5812

Fire, water, mold, rebuild

C&J Well Co

5450 W 96th St, Zionsville, IN 46077

Phone (317) 520-9899

Advanced Home Solution Inc.

Radon Detection & Reduction

Specialist

Phone (317) 247-1881

Affordable Radon & Mold Solutions

Phone (317) 513-9993

RESTORATION SERVICES

Indiana Contents Restoration

Phil Nicely

Mobile (317) 294-5812

Fine art restoration, book & document restoration

Step 1: Find Your Realtor/Advocate

These days most people start their home buying search by looking at sites such as Realtor.com, Zillow, or Trulia. That’s completely understandable, but when you are ready to move beyond the searching phase to the purchasing phase, the first thing to do is hire a Realtor to represent you and advocate on your behalf.

Search engines are fun while you are looking, but tedious when you’re seriously trying to find your next home. The sites aren’t 100% accurate, because listings that were never in the BLC (Broker Listing Cooperative), such as pocket listings or For Sale by Owner properties, will be missing. Sites aren’t always up to date, either. A property might show as still ‘Active’ on Zillow, even though it sold months ago.

Find a Realtor

How do you find a good Realtor? Hopefully, you’ll connect with me so we can see if we would be a good fit. Remember, not all Realtors are right for all people.

You need to find someone who is not only great at his or her job but someone you like and trust, as you’re going to be spending a lot of time with that person.

First, see if you click. If so, you need to determine if that person has the experience, customer service skills, and understanding of the market that you’re looking for.

Notice how quickly each Realtor responds to your initial phone call or email. The Realtor should get back to you within 24 hours; if not, that’s a bad sign. This business moves fast, and deals can fall apart if your Realtor doesn’t respond quickly on your behalf during negotiations.

Second, understand how to work with a Realtor. See Working with Real Estate Agents.

Third, expect to sign a buyer representation agreement. Legally, before you disclose confidential information to your Realtor, you should have a signed buyer representation agreement. It helps to ensure that your private information will be kept confidential.

So, let’s get together and have coffee and chat!

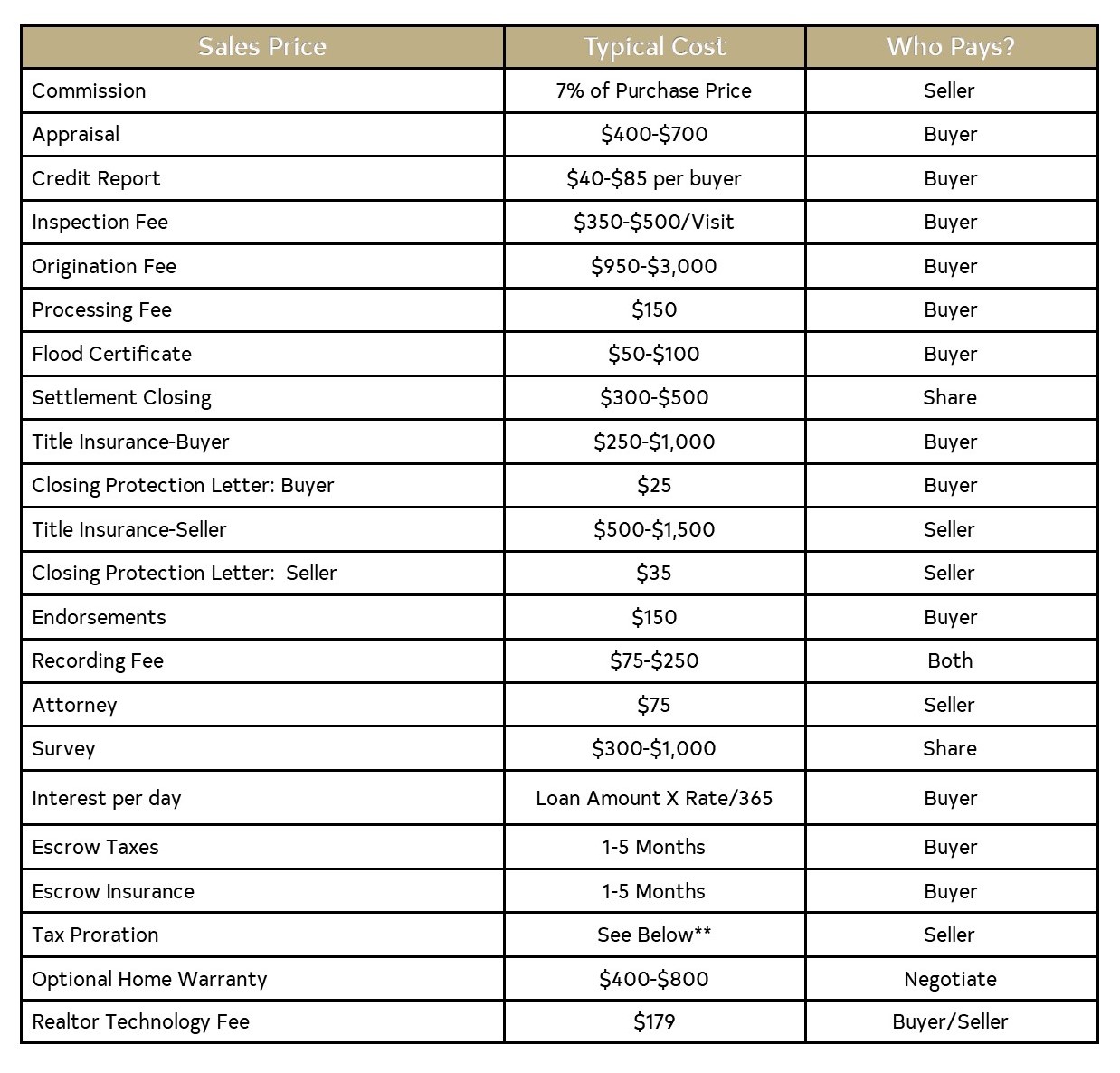

What do Sellers Pay For

Closing Costs

**Indiana property taxes are paid in arrears. Property tax prorations include any unpaid taxes for the previous year plus the prorated amount for the current year. Taxes are typically paid to the County Treasure on May 10th and November 10th. Taxes paid in May 2019 are for January 1, 2018 through June 30, 2018. Taxes paid in November 2019 are for July 1, 2018 through December 31, 2018.

Here’s how to calculate your prorated taxes:

Take prior year taxes divide by 365 = daily tax rate Daily tax rate x days passed in current year = Current year taxes accrued Current taxes accrued + Prior Year unpaid Taxes = Total Tax Proration.

Have any questions?

Call or text: 317.413.1360

Email me: LeeAnnBalta@C21Scheetz.com

Google Alert to Protect Your Property

Unfortunately, these days it seems scams and rip off artists are around every corner. As Realtors we run across a rental scam almost daily where the scammer has stolen pictures off the internet of a property for rent or sale, sets up their own fake rental on CraigsList using the photos and tries to lure a trusting tenant to rent the property sight unseen. This happens in both the city and the suburbs.

Unfortunately, these days it seems scams and rip off artists are around every corner. As Realtors we run across a rental scam almost daily where the scammer has stolen pictures off the internet of a property for rent or sale, sets up their own fake rental on CraigsList using the photos and tries to lure a trusting tenant to rent the property sight unseen. This happens in both the city and the suburbs.

So what can you do as a property owner to protect yourself?

Our best advice is to set up a Google Alert on your home or rental property. Google Alerts are simple and free tools to get regular updates about something that interests you, such as your property and your tenants. Google Alerts will send you an email any time a new web page appears in the top 20 web results or top 10 news results for the terms you specify.

As a homeowner, we also recommend setting up a Google Alert so you can make sure someone doesn’t try run a rental scam using photos of your property.

We also recommend parents set up Google Alerts on each of their children using the child’s full legal name, but that’s another story for another day!

Setting up a Google Alerts is simple. Go to http://google.com/alerts (note that you’ll need to have a Google login to use the service). For each Alert, you need to decide the following:

- Search Terms. This can be as simple as entering the property address in quotations. For example: “3537 Indy Drive.” You may also want to set up another alert if there are alternate ways your address may appear, for example including the abbreviation for “Drive” (making the alert active for: “3537 Indy Dr.”) or including the town (such as: “2201 Indy Dr, Evanston”). Using quotations around the search terms will help filter the results.

- Type of information to search. This tells Google which information to include in its search (Everything, News, Blogs, Web, Video, Groups) Setting this to “everything” will include all types of search results.

- How often the alert should be sent (as-it-happens, once a day, once a week). Google will send notifications only when it actually finds new material in the top 20 (web) / 10 (news) results, so you won’t be getting messages unless there’s something to report.

- Volume. This setting determines how many results you see in each alert.

- How you would like to receive the alerts (email or via RSS feed). For each alert you create, a separate email will be sent depending on how often you’ve chosen to receive it. You can also subscribe to the alert via RSS feed in Google Reader instead of email.

Caveat: Google Alerts is not guaranteed to be 100% foolproof or reliable. And since it only sends alerts when new pages enter into the top searches means it may not be an exhaustive result for every term. However, it’s a great place to start and helps you cover your bases!

Step 2: Get Preapproved for a Mortgage

So, You’ve picked ME as your Realtor…Yey!

Now what?

Now we need to get you ready and able to buy a home. This involves:

Paperwork!

Buying a home involves a lot of paperwork. But don’t worry, you picked the right agent when you hired me.

I will introduce you to a unique solution called dotloop. It is an online workspace that connects everyone and everything needed to complete a real estate transaction in one place. dotloop allows us to edit, complete, sign, and share documents without ever needing to print, fax, or email. It helps us eliminate actual paper and keep your transaction organized. We save all the documents there, and you will be able to see the process in action while I do the work.

You will create an account and will be able to fill out all the forms needed, from the convenience of your phone, tablet, or computer! You can also sign all of them in a secure and verified way.

It will speed up the process of buying a home by giving you the ability to make an offer the moment we find THE ONE and any other document that will need your approval and signature from there.

Pre-approval

As Realtors, we won’t put an offer on a house for a client unless he or she has been preapproved.

Without a pre-approval, the seller does not know if the offer is financially reliable. In addition, it’s essential that you have an understanding of how much you can comfortably afford to spend on a home, what your monthly payments will be at various price points, what interest rate you qualify for, and how much you’ll be paying each month in taxes, homeowner’s insurance, etc.

The Mortgage Underwriting Approval Process is an article that I highly recommend all buyers should read before applying for a mortgage.

Having the right mortgage lender is a crucial part of ensuring a smooth transaction. Working with a bad mortgage lender can make the process a living hell for everyone involved and put your purchase in jeopardy of not closing on time or at all. You could lose out on your dream property because your mortgage lender was disorganized and couldn’t get you fully approved during underwriting. Shop around to compare lenders. It’s important to work with the best.

Our Recommended Lenders:

Sue Vyzral

Hallmark Home Mortgage

317.694.1285

svyzral@1hallmark.com

Nick Claghorn

AnnieMac Home Mortgage

317.625.1206

NClaghorn@annie-mac.com

Janai Santana Roberts

Elements Financial

317.341.4925

jroberts@elements.org

Paperwork You Need to Gather

Each lender has slightly different requirements regarding what documentation they need from you for the pre-approval process, but in general, expect to provide the following items:

-

A completed application. The lender will give this to you directly.

-

The two most recent months (or a quarterly statement) for any assets listed on the application. Generally, checking, savings, 401k, mutual funds, individual stock accounts, IRAs, etc.

-

Your most recent paystub

-

Past two years of W2 forms

-

Past two years of Federal Tax Returns

-

Past two years of Corporate Tax Returns (if self-employed and you own over 25% of the company)

Getting a Pre-Approval Letter

Generally, once you submit the above items to your lender, you should receive a pre-approval letter within 2-3 business days. The lender may ask for additional documentation. They are not trying to be difficult by asking for additional documentation. After the housing bubble burst, underwriters became much stricter regarding the loan approval process, so a lot more documentation is needed today than it was 10 years ago.

In addition to receiving a pre-approval letter, which shows the amount of house you can afford, you should ask your lender how the preapproval amount breaks down in terms of a monthly mortgage payment plus any PMI, taxes, and insurance. That way you can make sure you are comfortable with what your monthly housing payment will be. Once you’ve received your pre-approval letter, forward it to me for your file so we can have it when we are ready to submit an offer.

Get a Loan Estimate and Understand Your Closing Costs

Also, mortgage lenders are required to provide you with a Loan Estimate (LE) within 3 days of receiving your pre-approval. The LE provides an estimate of the closing costs you’ll need on top of your down payment and shows exactly what fees the mortgage lender is charging you. Make sure you understand these fees.

Generally, we estimate closing costs to be approximately 2.5% of the purchase price of the property. Your mortgage lender will provide you with more detailed estimates based on your exact pre-approval amount. Remember, closing costs are due at closing (except for the appraisal and inspection fees, which are due on the day those services occur) and are on top of your down payment.

So, say you’re buying a $500,000 property and putting down 20%. You’ll need to have $112,500 cash available at closing ($100,000 for your down payment and approximately $12,500 for the closing costs).

Should You Shop Your Loan Around?

Absolutely! Every lender charges different fees and interest rates, so it’s crucial you shop your loan around to at least two lenders. We recommend waiting 2-3 weeks between meetings with lenders as the lender will need to pull your credit report to give you an accurate pre-approval letter. If your credit is pulled by various lenders in the same week, it could affect your credit rating by a few points. If you wait a few weeks, it generally won’t affect your credit rating at all.

How Much Can I Afford

There is ONE general fact in every homebuying research: houses are one of, if not the most, expensive purchases you’ll make in your lifetime. There aren’t many other opportunities to drop hundreds of thousands of dollars in one sitting… or over 30 years.

There is ONE general fact in every homebuying research: houses are one of, if not the most, expensive purchases you’ll make in your lifetime. There aren’t many other opportunities to drop hundreds of thousands of dollars in one sitting… or over 30 years.

This is why setting a house budget is crucial in the homebuying process. Even more modest purchases, like a new car, require examining the bank account, debt and income situation. With a home purchase, this kind of serious financial evaluation is everything if you are to have any hope of success.

A homebuyer should typically be able to afford a home that is 3 to 3.5 times your annual salary (or income). Another general rule is your total monthly expenses (including the new home) should never be above 45% of your gross (pretax) income.

For a first-time home buyer, we typically recommend for this ratio to be 35% or less. You should always consult with a professional mortgage advisor (not your typical order taker at the bank). And please remember that not all banks are created equal.

How much income do I need to qualify for a mortgage?

Many factors go into a lender’s decision to give you a mortgage. Among them are your credit score, debt-to-income ratio, employment history and income. Qualifying income is not just employment salary but other sources such as alimony, royalties, Social Security and trust income. Lenders will tally total income, subtract your debt and use the remainder to determine how much you can afford.

Lenders generally use the 28/36 rule for underwriting. This rule states that a household should spend 28 percent or less of their gross income on total housing expenses, including things like HOA fees, home insurance and property taxes. Likewise, total household debt — which includes everything from your mortgage to credit card bills and student loans, shouldn’t exceed 36 percent.

Therefore, please ask me or your friends and family for mortgage advisors recommendations. A mortgage advisor will let you know your qualification, how much home you can afford, what your monthly payments will be and what you should expect throughout the home buying process.

Our Recommended Lenders

Sue Vyzral

Hallmark Home Mortgage

317.694.1285

Janai Santana Roberts

Languages: English, Spanish and Portuguese

Elements Financial

317.341.4925

Lisa Stayton

KeyBank

317.501.7664

Step 4: Finding the Home of Your Dreams

The 80.10.10 Rule

At this point, you’re probably excited and full of optimism. You’ve gotten pre-approved and have (hopefully) started to complete the Buyer’s Questionnaire. Now comes the most important step: finding the right home.

I will have set you up for automatic search via the BLC (Broker Listing Cooperative). Each day (or however frequently you want to receive the search results) you’ll be emailed new properties on the market matching your criteria as well as any price drops on homes that were previously over your budget. This is a HUGE time saver. And if you’re in a market like Indiana, where great properties sell in a matter of days, it can be an enormous advantage to be able to get in and to see a property within a day or two of it going on the market.

Before we start, what is the 80/10/10 rule? No home will be perfect but thinking through the process I’ve outlined below will help eliminate homes that simply will not work for your family. However, once we begin looking at homes, I want you to think about them in this way:

-

Does this home meet 80% of my needs?

-

Can I change 10% to make the home meet 90% of my needs?

-

Can I live with the remaining 10% I cannot change?

Now make a list of your top 4-6 needs and a list of your top 4-6 wants. Examples of needs are:

-

3 bedrooms (because we have 2 kids that will fight and drive us crazy if they have to share a room)

-

In a certain school district/s

-

Yard for the dog (because you’re sick of walking the dog in the dead of winter)

-

Central AC (because the kids are driving you crazy complaining about the heat)

-

Updated and move-in ready (because you don’t even own a hammer)

These are the things you absolutely cannot live without. You won’t even see a property unless it has every one of the above items.

Then, make a list of your wants. Examples of wants are:

-

Hardwood floors throughout

-

Ensuite master bathroom with double sinks

-

Updated kitchen with granite and stainless steel

-

Wood burning fireplace

-

Rainbows over the home, flying unicorns, and pots of gold in every room

These are the things you’d really like but can live without if needed (unless your budget is $40 million, then we can probably find something with everything on your list).

Once you’ve made your lists, share them with me. That way when you see a property on the BLC that you love with the kitchen of your dreams, but I notice that it doesn’t have central AC, we won’t waste time seeing it.

When the email of listings comes, I need you to:

-

Review all of the properties sent to you that day. Hover over the shaded heart to mark properties you want to see as ‘Save as Favorite’. That tells me to schedule that home for you to view. Properties you want to think about longer, mark ‘Save as Possibility’. Properties you definitely don’t like mark as ‘Discard Listing’. If you have any questions about a particular property once you click on the address to bring up more information, write those questions in the ‘Notes for you and your agent’ located under the pictures. I’ll monitor those sections and will get answers back to you.

-

I’ll then ask that you select your top four or five properties. If time permits drive by the properties to look at the neighborhood, checking for anything undesirable. Eliminate any homes you no longer want to see. Don’t have time for a drive-by? Consider Google Maps instead.

-

Shoot me a quick text or email letting me know when you’re available. That way I can set up the showings.

-

NOTE that during the spring and summer, great properties sell in 3-4 days. It’s important that you review the BLC email daily so we can jump on a great property as soon as you see it.

-

I’ll bring printouts for each property so no need for you to bring anything other than snacks or drinks if you think you might get hungry.

While you’re looking at the BLC feeds each day I’ll also be networking with our contacts to find you homes, before they go on the market.

At this point, there should be no further need for you to look on Zillow, Trulia, etc., as all of those properties should be showing up in your BLC feed. If needed, we can fine-tune the search parameters of your BLC feed so you will only receive the listings that really get your heart fluttering!

Now on to the showings!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link